Integrating Risk Analysis into Deferred Maintenance Decision Making

With constant pressure to reduce maintenance costs as well as short-term budget constraints, asset managers are often compelled to continue operating aging assets while deferring maintenance and investment. As the consequences of such decisions are rarely immediate, it can seem relatively harmless to skip a PM or eliminate repairs/upgrades from an outage schedule. In fact, deferring maintenance and investment will often result in the desired outcome (cost reduction) in the short term, further reinforcing the practice.

However, problems can arise when these decisions are made in the absence of a technical evaluation or risk analysis. Without a robust analysis, it is impossible to understand all of the implications of the decision. An organization can be exposed to a level of risk that offsets any cost savings. Additionally, value can be lost if funds are not allocated to the activities which maximize their return on investment.

The objective of this article is to summarize a framework for deferred maintenance decision analysis and outline additional considerations beyond the quantitative analysis.

Deferred Maintenance Defined

For the purposes of this discussion and to maintain consistent communication, the definition for deferred maintenance outlined in the FASAB (US Federal Accounting Standards Advisory Board) accounting standard is referenced.

“7. Deferred maintenance and repairs (DM&R) are maintenance and repairs that were not performed when they should have been or were scheduled to be and which are put off or delayed for a future period.

8. Maintenance and repairs are activities directed toward keeping fixed assets in an acceptable condition. Activities include preventive maintenance; replacement of parts, systems, or components; and other activities needed to preserve or maintain the asset. Maintenance and repairs, as distinguished from capital improvements, exclude activities directed towards expanding the capacity of an asset or otherwise upgrading it to serve needs different from, or significantly greater than, its current use.”

A Framework for the Analysis

Analyzing the risks associated with deferring maintenance is not entirely different from performing a technical risk analysis such as Failure Modes and Effects Analysis (FMEA). The difference is that instead of analyzing the risk associated with each potential failure mode of the equipment, the objective is to analyze the risk associated with adjusting the timing or the scope of the maintenance task that is under scrutiny. The assumption is that the maintenance task already exists as part of the maintenance strategy, so the starting point of the analysis is at the task itself.

Similar to any traditional risk analysis, there are a number of parameters that must be considered. If the organization has a formal set of risk criteria these can be used to quantify the analysis. However it is favorable to report in terms of dollars as opposed to an arbitrary value such as a Risk Priority Number (RPN). This is simply because it provides a more meaningful and precise illustration of the impact to the operation.

Outlined below are the data requirements and steps to complete a deferred maintenance risk analysis.

Asset to be Analyzed

Clearly, the asset to be analyzed must be selected. The maintenance activity in question may be at the component level, but the analysis can be done at the equipment level for simplicity and efficiency.

Condition Assessment

The first step is to assess the condition of the equipment, where possible. This will provide a more accurate representation of the probability of failure of the equipment or the probability over time that it will degrade to a state in which it will begin to negatively impact the operation. The assessment can be as simple as a documentation of performance from a control system or as complex as a detailed structural assessment.

Criticality Assessment

Many of the data requirements for the risk analysis are shared with a criticality assessment. If a criticality assessment has been completed for the asset, the effects of failure such as safety, quality, and production impact can be utilized. This data will provide the majority of the “consequence” input to the risk calculation.

Technical Basis

In order to evaluate the maintenance task, the purpose or basis for it must be understood. What failure mode(s) is the maintenance task in place to manage or mitigate? Identification of the failure mode(s) will further clarify the “consequence” input to the risk calculation for both deferring and performing the maintenance.

Effects or Consequences of the Failure Mode

As previously stated, the effect of the failure mode on safety, quality, and production impact will provide much of the “consequence” input to the risk calculation. If the asset is already in a failed state, the current impact should be documented. Even if a formal set of risk criteria exists, the total impact to the operation should be monetized.

Incurred Damage

If the asset will incur incremental damage or accelerated wear as a result of deferred maintenance, the cost should be documented on an interval basis over time. An example would be extending lubrication intervals, which would result in reduced life of the asset. So the impact of the deferred maintenance is not just the consequence of failure, but also the increased cost of the asset due to premature replacement.

Probability of Occurrence

Risk is defined as probability multiplied by consequence, so naturally it is necessary to determine the probability that the failure will occur once the maintenance is deferred. The probability of failure should be determined on an interval basis to project the impact over time. The interval serves to illustrate the increasing probability of failure over time and help determine how long to defer the maintenance. It can be in months, years, turnaround cycles, etc. The probability should be calculated through data analysis, but it is acceptable to determine from experiential information.

If the asset is already in a failed state, the probability will be one, or if it is more suitable the probability can be calculated for secondary damage due to the loss of function of the asset (for example, a caustic or acid leak which is damaging nearby equipment). If the latter is the case, adjust the consequences accordingly.

Alternative Activities

If there are alternative activities (i.e. “band aids”) that may be cheaper and less effective, these can also be analyzed as a lower cost option to reduce risk versus a total deferment of maintenance.

Assess the Risk and Make the Decision

Once all of the aforementioned information is gathered, calculated and documented, the monetized risk of the deferment can be calculated as:

![]()

Comparing the expected value of the deferment (increased production output, on-time delivery, budget performance, etc.) to the monetized risk will enable management to make an informed decision on whether, and how long, to defer the maintenance activity.

A simple example to illustrate the analysis is outlined below.

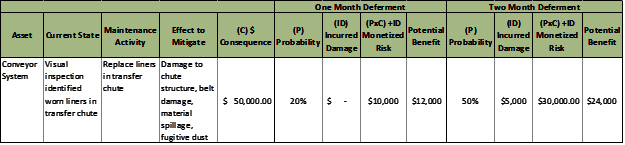

In the example, a visual inspection identified worn/thin wear liners in a conveyor system transfer chute. To correct the issue, a replacement of the wear liners is required.

The operations manager asks the asset manager to defer the maintenance to meet the production schedule, which is valued at $12,000 per month. Deferring the maintenance one month increases the probability of failure by 20% at a cost of $10,000. Deferring two months increases it to 50% plus incurs $5,000 worth of damage to the chute structure for a total cost of $30,000. Based on the analysis, the asset manager decides to defer the maintenance one month as the increased risk of deferring two months outweighs any potential benefits.

Additional Considerations - Financial

The risk analysis outlined is primarily focused on the acute operational risks to the organization as a result of maintenance deferments. However, there are other financial implications that may affect the organization’s willingness to accept risk.

The first is the type of expense. Operating expenses have been considered the scope of this analysis, however if the maintenance activity is substantial enough that the life of the asset is extended or the asset is upgraded to a point where it could be re-purposed, it may be a capital expense. If so, the asset is required to be recapitalized and the expense deducted over a period of time. As a result, the timing and scope of the activity should be reviewed to ensure alignment to the organization’s capital plan.

The next is cash flow. Although the risk assessment may determine an optimum timing for the maintenance activity, the cash position of the organization may not support the investment. Adjusting the timing of the maintenance activity may be required based on the availability of cash for the expense.

Additional Considerations - Strategic

Maintenance deferment decisions must also consider strategic implications. The strategic plan for the asset may change the availability requirements or even the future configuration of the asset which will ultimately affect the cost of risk.

Additionally, future market conditions will affect the cost of risk. If the asset utilization is expected to increase or decrease, maintenance deferment decisions should be aligned accordingly.

Application and Next Steps

Analyzing maintenance deferment decisions for risk obviously requires resources and time. Therefore it should be reserved for critical assets and cost-intensive activities. It can be done on an ad-hoc basis or systematically to form the foundation of the outage or turnaround plan.